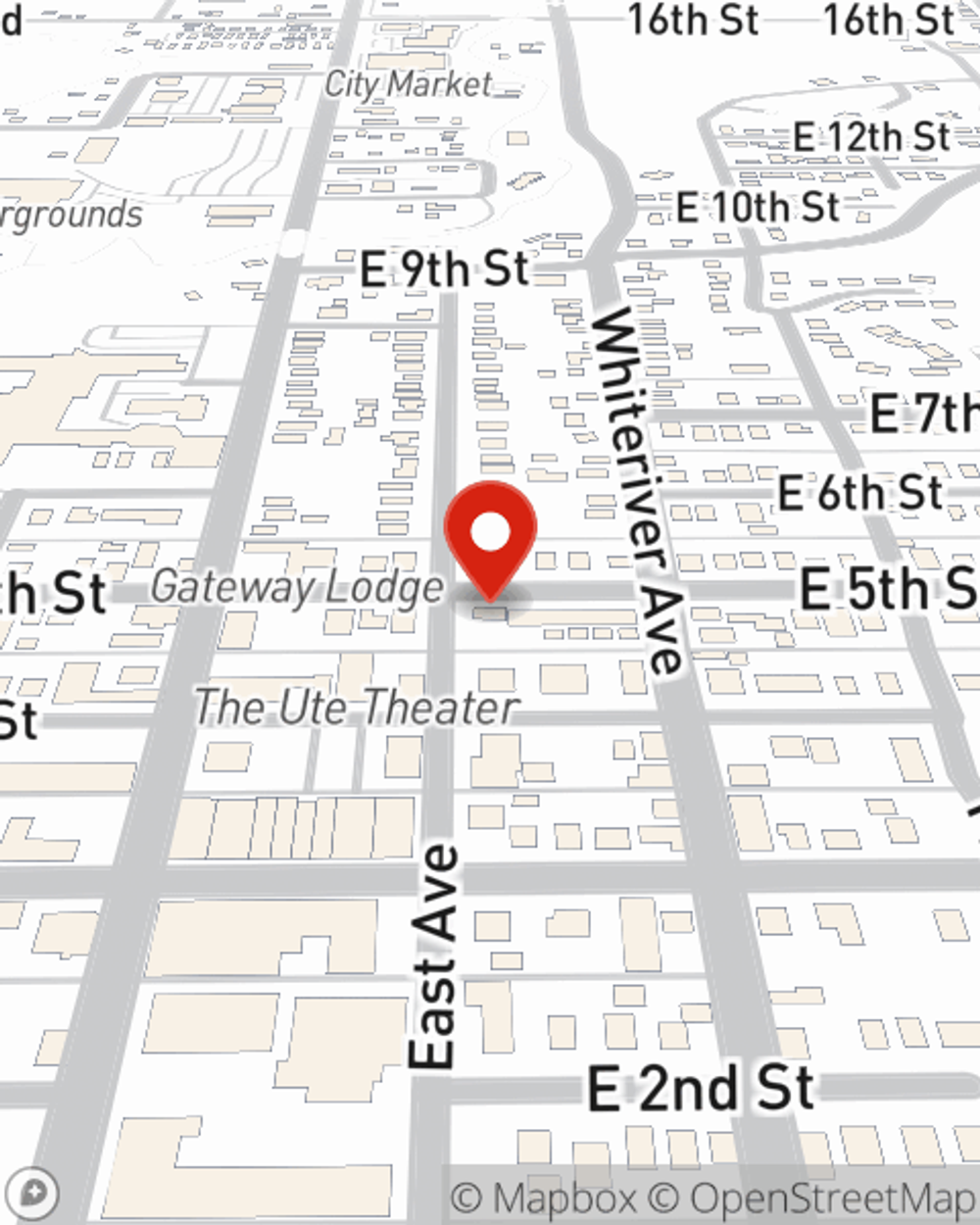

Renters Insurance in and around Rifle

Get renters insurance in Rifle

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Silt

- Grand Junction, CO

- New Castle, CO

- Glenwood Springs, CO

- De Beque, CO

- Fruita, CO

- Meeker, CO

Home Sweet Home Starts With State Farm

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented condo or apartment, renters insurance can be the right next step to protect your belongings, including your TV, stereo, bed, smartphone, and more.

Get renters insurance in Rifle

Renters insurance can help protect your belongings

Renters Insurance You Can Count On

Renting a home makes the most sense for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance might cover repairs for damage to the structure of your rented home, but that doesn't include what you own. Renters insurance helps protect your personal possessions in case of the unexpected.

There's no better time than the present! Reach out to Jesse Dalton's office today to learn how you can protect your belongings with renters insurance.

Have More Questions About Renters Insurance?

Call Jesse at (970) 665-9770 or visit our FAQ page.

Simple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Jesse Dalton

State Farm® Insurance AgentSimple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.